1 Which of the Following Are Contractionary Fiscal Policies

When the volume of net exports is unusually low B. The Federal Reserve lowers the target for the federal funds rate.

The government passes a new law that explicitly changes overall tax rates or spending levels with the intent of influencing the level or overall economic activity.

. A Increasing capital gains taxes. The reduction of government spending. A leaves aggregate demand unchanged.

This is not part of fiscal policy. Which of the following are contractionary fiscal policies. D a and b.

Increased taxation and increased government spending Increased taxation and decreased government spending Decreased taxation and no change in government spending No change in. When the level of economic output is running unusually high. Tutorial 7 1Define Fiscal Policy Fiscal policy is an economic policy that can be implemented by the government to solve the economy.

Which of the following would be viewed as contractionary fiscal policy. During which of the following situations would the government most likely have a contractionary fiscal policy. Contractionary fiscal policy according to the ADAS model what would happen in the 2008 financial crisis.

Contractionary policies aim to reduce the rates of monetary expansion by putting some limits on the flow of money in the economy. Contractionary policies are typically issued during times of. B increases aggregate demand.

The individual income tax rate is decreased. Which of the following would not be an example of contractionary fiscal policy. Define fiscal policy and explain whether the government should implement an expansionary or contractionary fiscal policy during the pandemic.

When the economy is in a trough of the business cycle C. Contractionary fiscal policy is the government increase revenue and reduce expenditure to curb inflationary gap. An increase in government purchases or a cut in taxes increases expenditure on goods and services which in turn increases the production of goods and services.

Contractionary fiscal policy is explained as a decline in government expenditure. Cuts in government purchases and increases in taxes are referred to as contractionary fiscal policy. A distorted credit market 3.

C Buying treasury bills. An increase in taxes. Decreasing money spent on social programs B.

Increased taxation and decreased government spending If the Congress passes legislation to reduce taxes to counter the effects of a severe recession then this would be an example of. Doing nothing with a temporary budget surplus. A A decrease in income tax B A decrease in the budget deficit C An increase in government spending D An increase in the rate of interest 1 mark urious Education Fiscal policy involves the use of A interest rates.

Contractionary is designed to. This is a contractionary fiscal policy because it is an increase in taxes that will reduce disposable income. 1Which of the following is an example of contractionary fiscal policy.

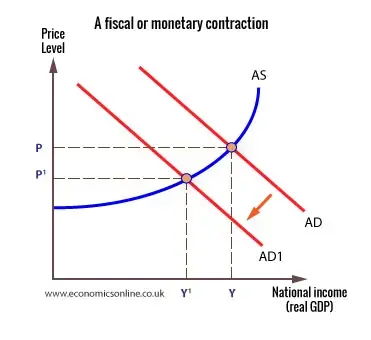

A budget deficit or surplus usually determines the type of fiscal policy either as contractionary or expansionary. AD would fall wages would fall SRAS would increase and the economy would be self-corrected at lower prices in the long run the indirect costs of government debt involve. C decreases aggregate demand.

Increasing money spent to pay for government projects E. Click card to see definition. E None of the above.

Fiscal policy that decreases the level of aggregate demand either through cuts in government spending or increases in taxes discretionary fiscal policy. Explain how each of the following affects aggregate demand. Fiscal policy attempts to achieve all of the following objectives except All of the following are examples of fiscal policy except.

Which of the following fiscal policy changes would be the most expansionary. This is not part of fiscal policy. A Increasing capital gains taxes.

C the money supply. When the inflation rate is negative D. B Decreasing the budget for national defense.

1Which of the following is an example of contractionary fiscal policy. B direct and indirect taxes. Part of a contractionary fiscal policy.

Define contractionary fiscal policy and list its. Under a recession an expansionary fiscal policy is adopted which involves lowering taxes andor increasing government spending. The Contractionary fiscal policy definition involves.

Alternatively it can be defined as a raise in taxes that causes the governments budget surplus to increase or its budget deficit to decrease. This is an expansionary fiscal policy because it is an increase in government transfers that will increase disposable income c. Supply-side fiscal policies include all of the following EXCEPT.

Families are allowed to deduct all their expenses for daycare from their federal income taxes. The 3 forms include. Canceling the annual cost of living adjustments to the salaries of government employees D.

Increasing income taxes C. This is contractionary fiscal policy because it is a reduction in government purchases of goods and services b. During the Coronavirus pandemic the United States launched many fiscal policy initiatives to stabilize and grow the United States economy.

434 Using the IS- LM Model to Analyze Fiscal Policy. Which one of the following policy changes represents a contractionary fiscal policy. Tap card to see definition.

Defense spending is increased. For this assignment complete the following in paragraph form. 1 a reduction in government purchases of goods and services 2 an increase in taxes and 3 a reduction in government transfers.

A reduction of transfer payments. In an overheated expansion with an inflationary pressure a contractionary fiscal policy is utilized which requires higher taxes andor reduced government spending. D increases aggregate supply.

This is not part of fiscal policy.

Using Fiscal Policy To Fight Recession Unemployment And Inflation

What Are Expansionary And Contractionary Fiscal Policies And What Situations Are They Used Quora

Using Fiscal Policy To Fight Recession Unemployment And Inflation

No comments for "1 Which of the Following Are Contractionary Fiscal Policies"

Post a Comment